Shiba Inu (SHIB) has surged 5% in the past 24 hours, mirroring a broader crypto market rebound. Bitcoin (BTC) and Ethereum (ETH) have also gained momentum, helping major altcoins recover from recent dips. However, upcoming US Consumer Price Index (CPI) data and potential Ukraine peace talks could influence SHIB’s next move.

Shibarium’s Growing Activity Fuels Optimism

Shibarium, the layer-2 blockchain for Shiba Inu, has seen a significant increase in activity. Over the past 24 hours, the network has processed nearly 250,000 transactions. This surge marks a notable improvement from the lower transaction levels recorded earlier this month.

The renewed activity has strengthened investor confidence. Shibarium enhances SHIB’s ecosystem by improving transaction efficiency and enabling decentralized applications. Crypto analyst Davinci Jeremie recently emphasized its potential, stating that SHIB could experience a major rally if developers create more use cases for Shibarium. He believes utility will determine the token’s long-term success.

Shiba Inu(SHIB) Holders Move Tokens Off Exchanges

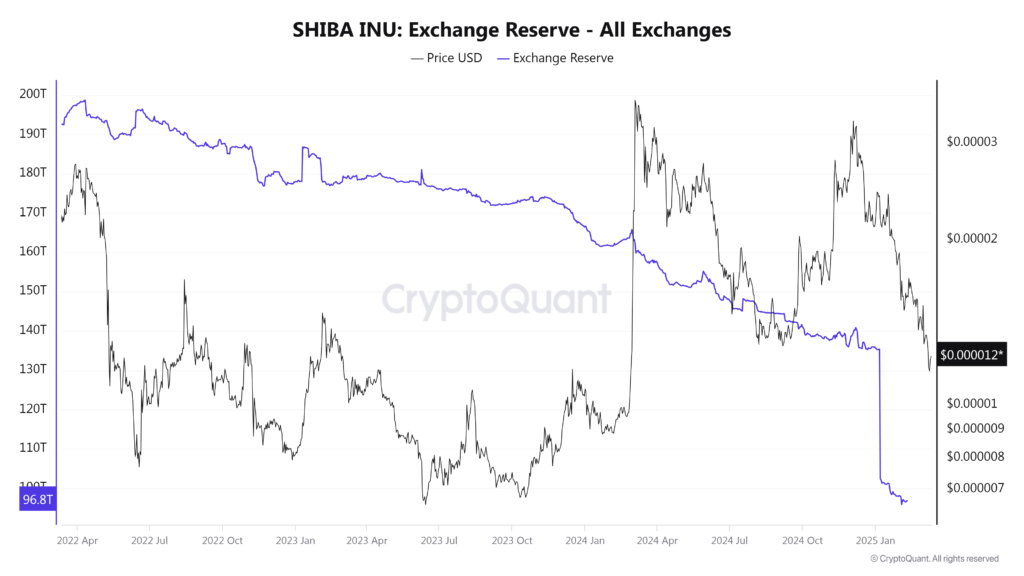

On-chain data from CryptoQuant reveals that SHIB’s exchange reserves have dropped almost to a four-year low of 94.2 trillion tokens. Investors often move tokens to self-custody when they expect prices to rise. This trend reduces immediate selling pressure and signals growing confidence in SHIB’s potential gains.

Read Also: XRP Drops Below $2—Can Whales Push It Back to $2.63?

Lower exchange reserves indicate that fewer tokens are available for quick sell-offs. When demand increases and supply remains limited, prices tend to rise. Many traders interpret this as a bullish indicator.

Crypto Market Rebound Lifts SHIB’s Price

The broader crypto market has contributed to SHIB’s price surge. Bitcoin and Ethereum have both recorded strong gains, reversing losses from previous weeks. As major cryptocurrencies recover, meme coins like SHIB often follow the trend.

Market sentiment plays a crucial role in meme coin performance. When confidence returns to the crypto space, speculative assets like SHIB benefit from renewed investor interest. If Bitcoin and Ethereum maintain their upward trajectory, SHIB could continue gaining momentum.

Will CPI Data and Peace Talks Impact Shiba Inu?

While SHIB’s price increase is encouraging, macroeconomic and geopolitical factors could affect its next move. The upcoming US CPI data will provide insights into inflation trends, which influence Federal Reserve policies. Lower-than-expected inflation could boost investor confidence, while higher inflation might trigger market uncertainty.

Meanwhile, potential peace talks regarding the Ukraine conflict could impact global financial markets, including cryptocurrencies. Positive developments could strengthen investor sentiment, while negative news might slow the rally. These factors will likely contribute to short-term volatility in the crypto space.

Is Now the Right Time to Buy SHIB?

Several bullish signals suggest SHIB could continue its upward movement. Shibarium’s growing activity, declining exchange reserves, and the broader crypto market’s recovery all support a positive outlook. However, external economic events may introduce fluctuations in the short term.

Traders and investors should monitor CPI data and geopolitical updates closely. These factors could determine whether SHIB extends its rally or faces a pullback. Staying informed will help investors make better trading decisions in a volatile market.

SHIB’s Future Hinges on Market Trends

SHIB’s recent 5% price surge reflects a mix of internal growth and external market dynamics. Shibarium’s increased transaction volume has boosted optimism, while declining exchange reserves indicate a shift toward long-term holding. The broader crypto market’s recovery has also played a role in SHIB’s gains.

However, CPI data and geopolitical developments could introduce volatility. If macroeconomic conditions remain favorable, SHIB might break higher price levels. If uncertainty increases, the token could face short-term corrections.

Read Also: 23% Pi Network Drop: Should You Buy the Dip or Exit Now?

For now, SHIB’s bullish momentum remains intact. Investors should stay alert and watch key market trends to navigate potential price swings. The coming days will determine whether SHIB extends its rally or consolidates before another breakout.