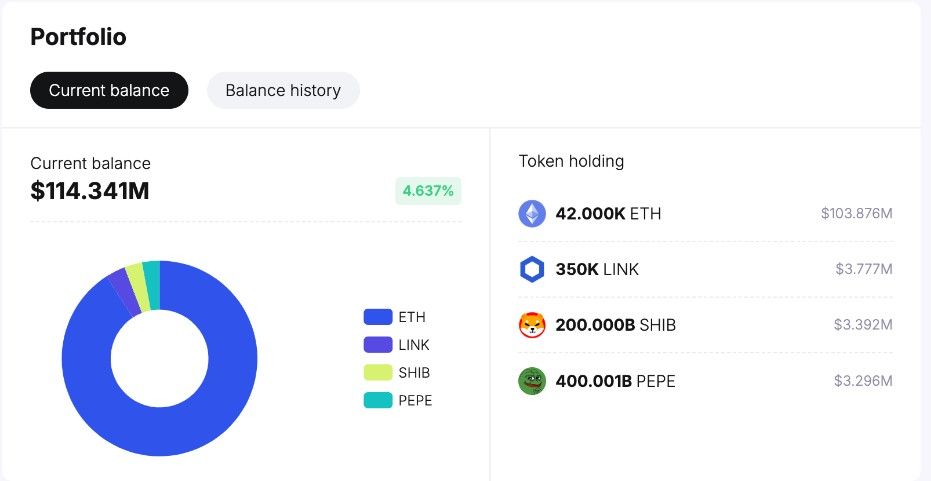

In a major move, Gemini has added 200 billion Shiba Inu (SHIB) tokens, worth about $3.39 million, to a new multisignature custody wallet. This new wallet, created just 18 days ago, has rapidly amassed a variety of altcoins, highlighting Gemini’s strategic positioning in the altcoin space. In addition to SHIB, the wallet holds significant amounts of other assets like Ethereum (ETH), Chainlink (LINK), and PEPE tokens, showing Gemini’s commitment to building a diversified portfolio for its clients.

Altcoin Holdings in Gemini’s New Wallet

The new Gemini wallet, labeled “0xc96,” holds 42,000 ETH, valued at approximately $103.8 million. This substantial holding in Ethereum further underscores Gemini’s emphasis on established cryptocurrencies alongside its recent acquisition of meme-inspired tokens. Alongside ETH, the wallet contains 350,000 LINK tokens, worth $3.77 million, and an impressive 400 billion PEPE tokens valued at around $3.29 million. These assets, stored in a single wallet, demonstrate Gemini’s robust custodial services and its active interest in maintaining a broad range of crypto assets.

Increased Institutional Interest in Shiba Inu (SHIB)

The acquisition of 200 billion SHIB tokens signals rising institutional interest in Shiba Inu. Initially launched as a playful alternative to Dogecoin (DOGE), SHIB has evolved into a significant community-driven project. With a loyal following and increasing adoption in the crypto community, SHIB appeals to both new and existing investors. By securing such a large quantity of SHIB, Gemini has shown confidence in SHIB’s potential, potentially making it more attractive for other institutional players.

Gemini’s Commitment to Custodial Services

Founded by the Winklevoss brothers in 2014, Gemini remains a major force in the cryptocurrency world. The exchange currently manages assets worth $6.05 billion and sees an average daily trading volume of $53.98 million. By consolidating millions of dollars in altcoins into its new wallet, Gemini appears to be strengthening its custodial offerings. This move aims to secure popular assets and provide investors with the assurance of Gemini’s advanced custodial infrastructure.

Read Also: Dogecoin Signals Bull Run with Key Support: Price Target Revealed!

Gemini’s decision to actively accumulate altcoins, including 200 billion SHIB, highlights its strategic commitment to expanding its altcoin custody services. By aligning with community-focused projects like SHIB, Gemini not only supports emerging crypto assets but also attracts a broader audience of investors. This active accumulation of assets indicates Gemini’s long-term vision for growth and its role in providing secure, diversified investment options for the future.