Founded in 2017 and launched through an IEO on Binance in March 2019, Fetch.ai is at the forefront of the artificial intelligence and blockchain convergence. The platform builds an open, permissionless decentralized machine-learning network underpinned by a unique crypto economy. It democratizes access to AI technology, allowing users to interact with secure datasets through autonomous agents. This technology specializes in optimizing numerous applications, including decentralized finance (DeFi), transportation systems, and energy grids.

With a current market price of $1.36, Fetch.ai has a market capitalization of $3.32 billion, showcasing a promising position in the competitive AI space. The platform has garnered significant attention due to its innovative approach, tapping into the potential of large-scale datasets for diverse applications.

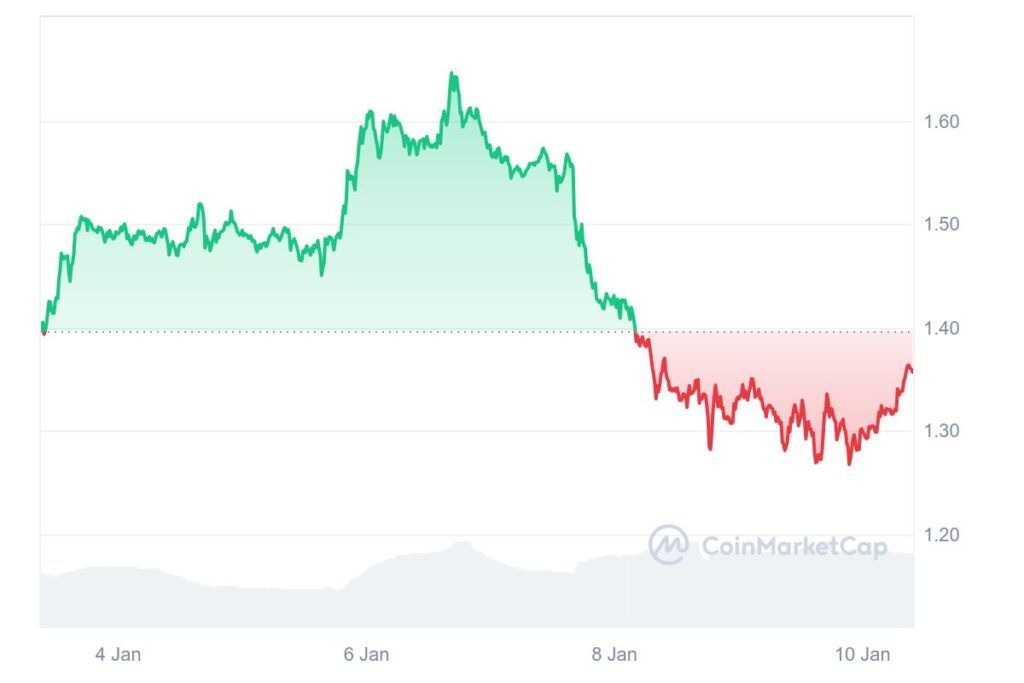

Price Performance Overview

In the past seven days, Fetch.ai’s FET token has experienced a 2.47% decrease in value, highlighting recent fluctuations in the market. The price ranged from a low of $1.26 to a high of $1.37, indicating a relatively stable trading range amidst broader market volatility.

On January 8, 2025, Fetch.ai’s price was around $1.3336, with a trading volume of approximately $435.89 million. The token’s price dropped slightly as it approached the week’s end, with market participants continuously evaluating its potential amidst evolving trends in AI and blockchain.

Market Dynamics

The price trajectory of FET reflects a blend of investor sentiment and external market factors. The slight decline in the last week can be attributed to various influences, such as overall market corrections and the performance of rival tokens in the AI sector. As the price charts show, movement within that $1.26-$1.37 range indicates a period of consolidation, which is not uncommon for assets in a rapidly emerging market like Fetch.ai.

Investor Sentiment and Trading Volume

The trading volume plays a crucial role in price movements, and with a reported volume of $379.63 million over the last 24 hours, there is sustained interest from both retail and institutional

Related Article:Cardano Faces Resistance: What’s Holding Back the Rally?

investors. Notably, 64.91% of FET addresses are held by “cruisers”—individuals holding tokens long-term—compared to 9.11% by traders and 25.98% by casual holders. This suggests a resilient base of investors optimistic about Fetch.ai’s future, despite recent price fluctuations.

Future Outlook

Looking forward, the sentiment around AI technology and its integration with blockchain remains overwhelmingly positive. Fetch.ai’s unique offerings position it favorably within this landscape, and its new collaborations within the Artificial Superintelligence Alliance—a consortium of AI and blockchain projects—could yield significant advancements.

Related Article: Price Analysis: Sandbox (SAND), A Bumpy 7-Day Ride, Is the Metaverse Token Gaining Momentum?

Given the innovative nature of Fetch.ai’s platform, industry analysts remain hopeful for an upswing in value, especially as more use cases for AI emerge. Market watchers are closely monitoring developments and updates related to Fetch.ai, as any major partnership or breakthrough could significantly impact trading sentiment and price action in the near future.