Dogecoin (DOGE) has seen dramatic price swings, leaving traders uncertain about its next move. After breaking out from a symmetrical triangle pattern, DOGE failed to sustain momentum and dropped to $0.2123. This decline has sparked concerns about market stability and the token’s future.

A Breakout That Backfired

Dogecoin seemed ready for a rally, but reality struck hard. The breakout from its symmetrical triangle, which ranged between $0.236 and $0.224, initially suggested a bullish run targeting $0.197. However, momentum faded quickly, and key indicators confirmed a bearish reversal. The failed breakout left traders questioning the token’s next move.

Bearish Indicators Signal More Trouble

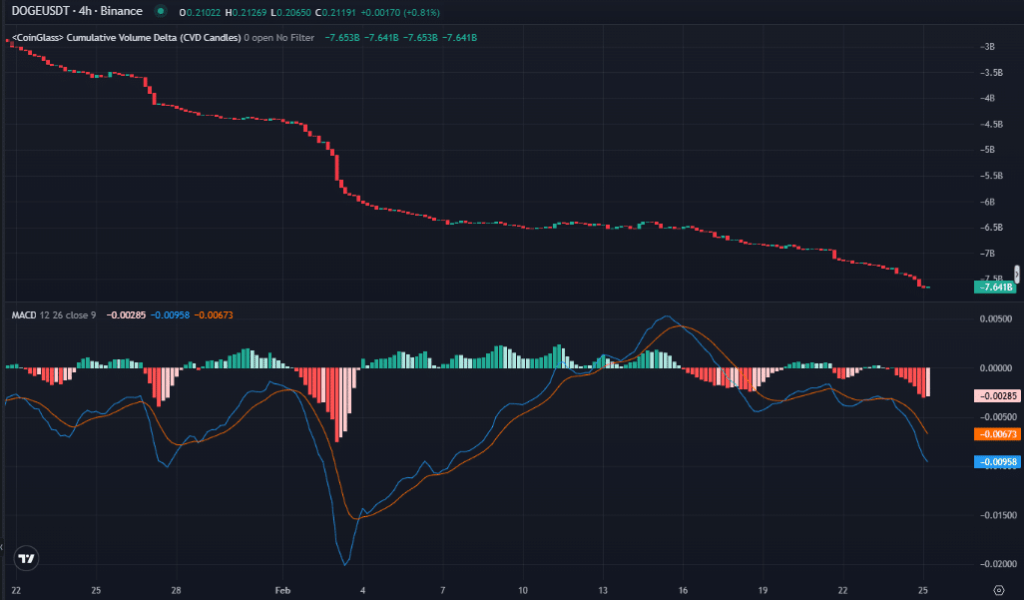

The charts reveal a troubling picture for DOGE. Fibonacci retracement levels show that the token struggled to stay above the crucial 61.8% retracement level at $0.218, signaling strong selling pressure. The MACD line crossing below the signal line reinforced the bearish outlook, hinting at further losses. The Cumulative Volume Delta (CVD) surged to -7.64B, indicating intense selling pressure that solidified the downtrend.

Are Traders Losing Confidence?

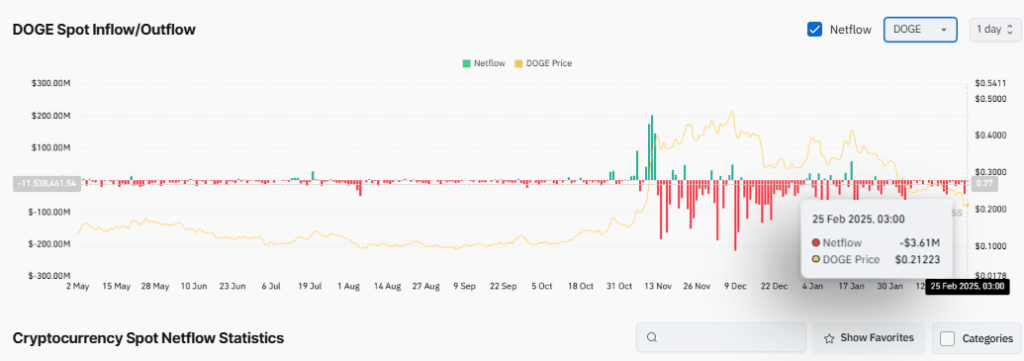

Market sentiment plays a crucial role in price movements, and DOGE’s trading activity suggests growing uncertainty. Over the past 24 hours, DOGE saw outflows of -3.1M, meaning more traders are selling than buying. The drop below $0.22 coincided with this surge in selling, signaling reduced confidence in a near-term recovery. If this trend continues, DOGE may struggle to regain lost ground.

Market Stability or Further Decline?

DOGE’s 4-hour chart reveals a sharp decline in volatility. The Volatility Index fell to 0.23155, suggesting traders are adopting a wait-and-see approach. With DOGE stabilizing around $0.2123, it remains unclear whether the token will consolidate before rebounding or face another downturn. If volatility remains low, the price may continue hovering at current levels before traders make their next move.

What’s Next for DOGE?

Dogecoin faces an uphill battle as bearish signals persist. Declining netflows, reduced volatility, and strong selling pressure suggest a possible test of the $0.20 support level. Broader market trends, particularly in the meme coin sector, will influence whether DOGE recovers or dips further. If buyers step in, DOGE might see a short-term rebound, but sustained growth remains uncertain.

Read Also: Dogecoin (DOGE) Faces 5% Drop: Will It Plummet Below $0.20?

Dogecoin’s price action presents both risks and opportunities. Risk-tolerant investors may see this dip as a buying opportunity before a potential rebound. However, cautious traders may prefer to wait for confirmation of a trend reversal. Observing key support and resistance levels will be crucial in determining DOGE’s next move.

Damilola Ojoye

Oluwadamilola Ojoye is a seasoned crypto writer who brings clarity and perspective to the fast-changing world of digital assets. She covers everything from DeFi and AI x Web3 to emerging altcoins, translating complex ideas into stories that inform and engage. Her work reflects a commitment to helping readers stay ahead in one of the most dynamic industries today