The crypto market has faced intense volatility in the first week of March. Traders reacted sharply to President Trump’s unexpected announcement about adding altcoins to the US crypto reserves. This news triggered massive liquidations, with over $1 billion wiped out across multiple altcoins. Market sentiment remains fragile as traders adjust their strategies in response to this regulatory shift.

How Regulatory News Affects Trader Behavior

New tax policies and regulatory frameworks have significantly impacted capital flows. As the administration introduces changes, traders scramble to reposition their holdings. This shift has created noticeable imbalances on liquidation maps, signaling possible future liquidation events. Increased trading activity reflects uncertainty, and sudden movements could trigger further sell-offs. In such an unstable environment, staying ahead of market trends becomes crucial.

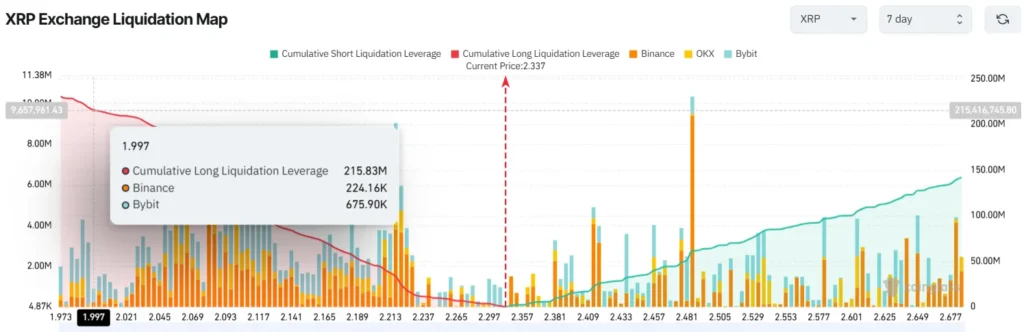

XRP (XRP) Approaches a Critical Level

XRP faces a crucial test as traders monitor its next move. The 7-day liquidation heatmap suggests a sharp rise in long liquidations if the price dips below $2. Currently trading at approximately $2.33, XRP has already lost 20% in recent days. If it drops further, total long liquidations could exceed $215 million.

Exchange liquidation maps reveal a strong trend toward long positions, which increases downside risk. Additionally, whale movements add uncertainty. Shortly after Trump’s announcement, an escrow account unlocked 500 million XRP, raising concerns about potential sell pressure. With traders wary of further losses, XRP’s price trajectory remains unpredictable.

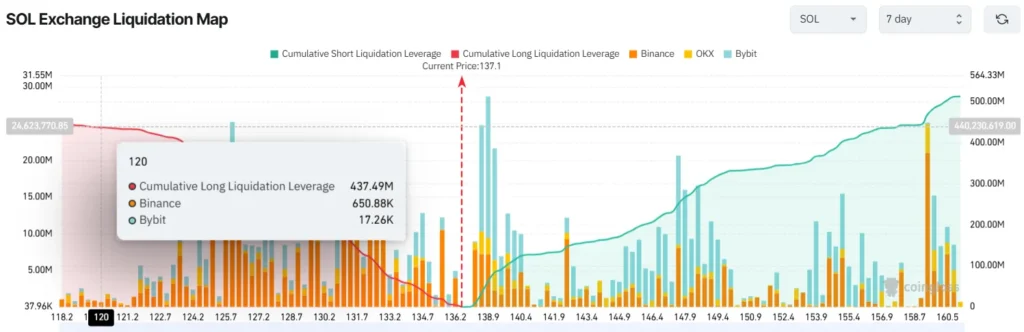

Solana (SOL) Risks Major Liquidations

Solana finds itself in a precarious position. If SOL drops to $120, long liquidations could surpass $437 million. This scenario represents an 11% decline from its current trading price of $136.3. Traders remain on edge as large transfers from an FTX/Alameda-linked wallet to Binance create additional pressure.

These movements suggest possible sell-offs, leading to speculative trading and increased liquidation risks. If SOL fails to hold key support levels, market-wide panic could set in. Investors must closely monitor whale activity and liquidity trends to navigate this uncertain phase.

Cardano (ADA) Faces High Volatility

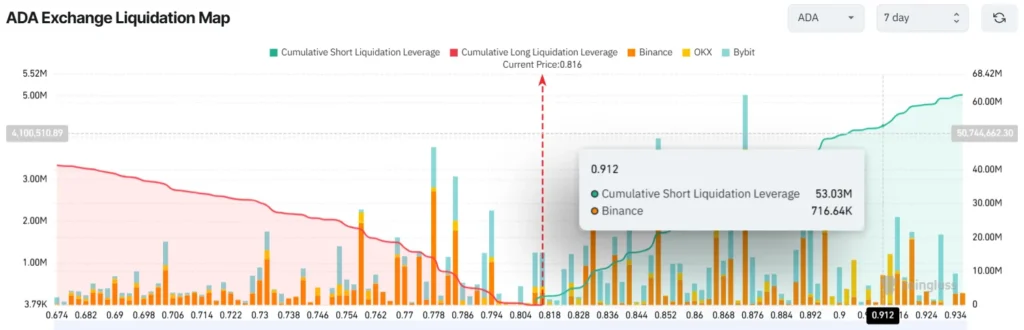

Cardano also presents significant liquidation risks. If ADA rises above $0.90, short liquidations could exceed $50 million. Currently trading at $0.81, ADA’s lower market depth makes it more vulnerable to price swings than its competitors.

Recent analyses from Kaiko suggest ADA could experience the highest price volatility among major cryptocurrencies. The reduced market depth amplifies risks, making ADA particularly sensitive to sudden price shifts. If traders push ADA past critical levels, liquidation events could accelerate.

Navigating a Volatile Crypto Market

Extreme volatility dominates the current crypto landscape. Regulatory news has forced traders to rethink their strategies, leading to unpredictable price movements. XRP, SOL, and ADA face heightened liquidation risks, increasing market uncertainty.

Read Also: Cardano Rockets 50% After Reserve Inclusion – Will ETF Be Next?

To navigate these challenges, traders must remain vigilant. Leverage amplifies risks, making it essential to assess potential price swings before taking positions. As regulatory developments unfold, market sentiment could shift rapidly. Understanding these dynamics will help traders adapt and avoid costly liquidation events.