Cardano experienced a dramatic 60% surge over the weekend, surpassing $1 on Sunday. The price rally followed U.S. President Donald Trump’s announcement of a national digital asset reserve, which included ADA. Enthusiastic traders pushed the price higher, anticipating long-term growth. However, the excitement quickly faded, leading to significant profit-taking.

The initial price spike turned out to be short-lived. Over the past 24 hours, ADA dropped by 20%, falling below $1. Market sentiment shifted as speculative traders capitalized on the rally, causing downward pressure. At press time, ADA trades at $0.82, reflecting declining interest from investors.

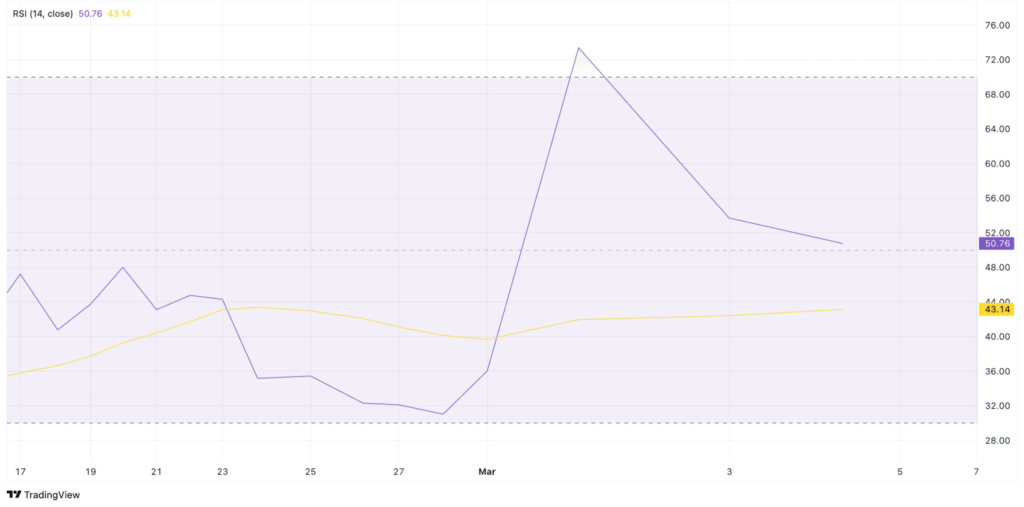

Technical Indicators Signal Bearish Momentum

On the daily chart, technical indicators highlight weakening demand for ADA. The Relative Strength Index (RSI) is trending downward, showing reduced buying pressure. This momentum indicator, which measures overbought and oversold conditions, now approaches the crucial 50-line.

A downward RSI movement suggests sellers are dominating the market. If it falls below 50, bearish momentum could strengthen further. In contrast, an RSI above 50 would indicate growing bullish control. Since ADA’s RSI is declining, traders appear more inclined to sell rather than buy, amplifying downward pressure.

ADA Faces Risk of Breaking Below Its 20-Day EMA

ADA’s price currently hovers near its 20-day Exponential Moving Average (EMA), a critical short-term trend indicator. The 20-day EMA tracks an asset’s price over the past 20 days while giving more weight to recent fluctuations.

A drop below this moving average signals weakening momentum and increased selling activity. If ADA confirms a break below this level, the bearish trend could intensify. Market participants would then expect further declines, reinforcing negative sentiment.

Can ADA Rebound to $0.94?

At $0.82, ADA rests above key support at $0.72. If selling pressure intensifies, this support may fail to hold. In that scenario, ADA’s price could decline further toward $0.60, worsening its short-term outlook.

However, renewed buying interest could change this trajectory. If new investors enter the market and stall profit-taking, ADA could rebound to $0.94. A successful push above this resistance level may propel Cardano toward a three-month high of $1.32, restoring investor confidence.

Read Also: Cardano Rockets 50% After Reserve Inclusion – Will ETF Be Next?

Traders should monitor price movements closely and use risk management strategies. Setting stop-loss orders and tracking resistance levels will help navigate potential price swings. Whether Dogecoin recovers or drops further, staying informed is crucial for making smart trading decisions.

Damilola Ojoye

Oluwadamilola Ojoye is a seasoned crypto writer who brings clarity and perspective to the fast-changing world of digital assets. She covers everything from DeFi and AI x Web3 to emerging altcoins, translating complex ideas into stories that inform and engage. Her work reflects a commitment to helping readers stay ahead in one of the most dynamic industries today