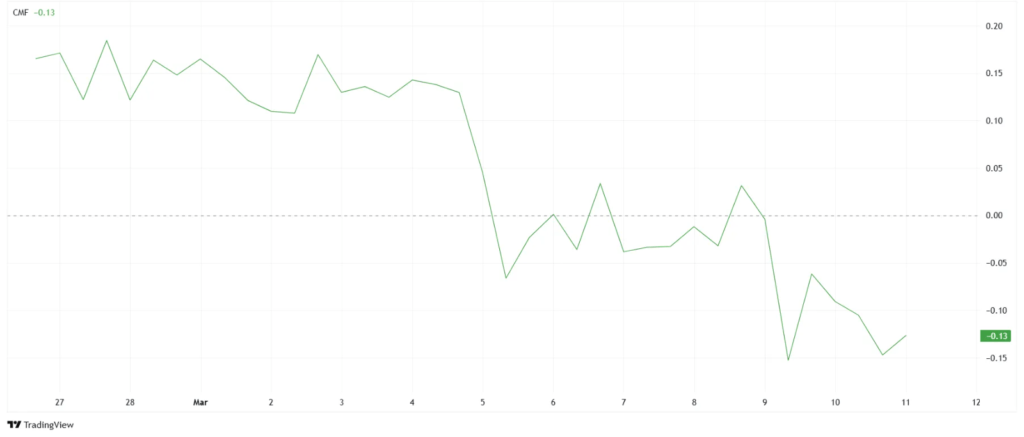

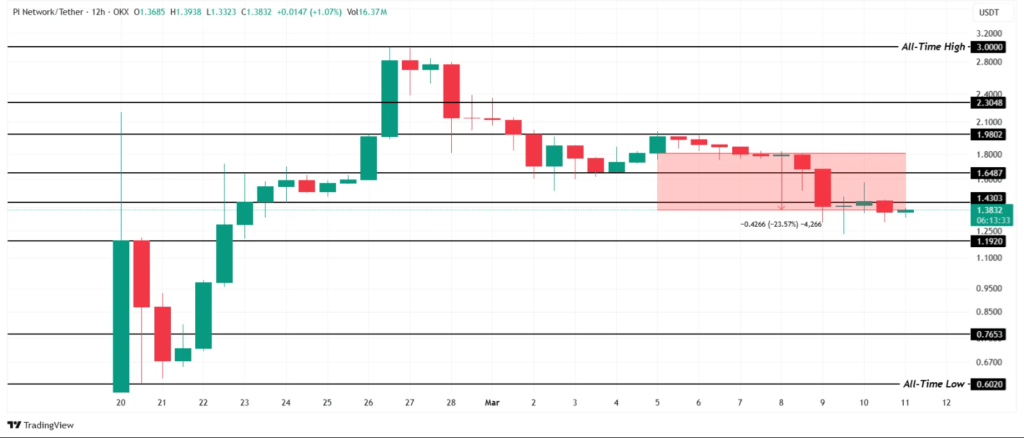

Pi Network (PI) has struggled as investors continue to withdraw their funds. Over the past week, the token dropped 23%, reaching $1.38. This decline signals a broader loss of confidence, making recovery increasingly difficult. The Chaikin Money Flow (CMF) indicator confirms this bearish trend, showing that outflows are far greater than inflows. When more people sell than buy, the price naturally declines, and that’s exactly what is happening to Pi Network.

Market hesitation keeps Pi Network from regaining its momentum. The lack of fresh investment leaves the token vulnerable to further losses. Until investor sentiment shifts, any recovery attempt may struggle to gain traction.

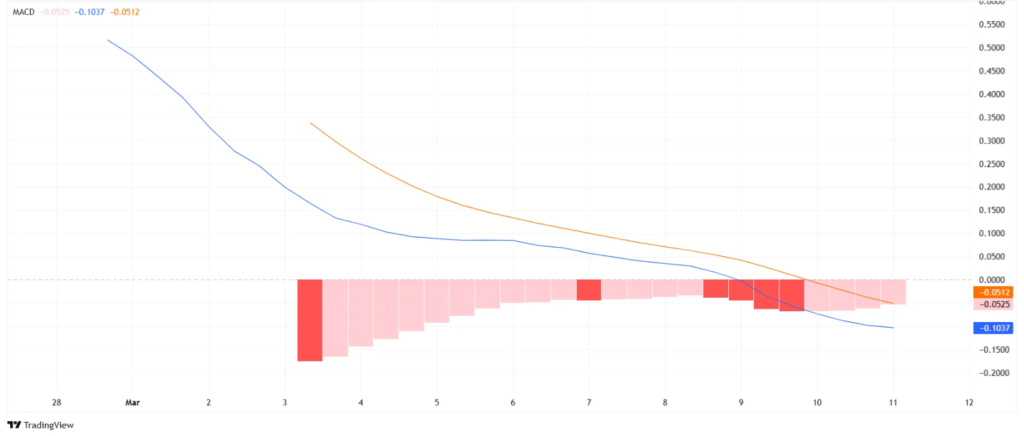

Bearish Momentum Continues to Dominate

The Moving Average Convergence Divergence (MACD) indicator provides more evidence of the ongoing downturn. Red bars continue to appear on the histogram, reinforcing the bearish outlook. Every attempt at a rebound faces resistance, as weak demand prevents significant price increases.

The broader cryptocurrency market also faces uncertainty, further weighing on Pi Network’s performance. While some assets have shown signs of resilience, Pi Network has failed to break free from negative sentiment. Unless the trend reverses, the token may continue to decline, putting additional pressure on long-term holders.

Pi Network Faces Critical Support and Resistance Levels

Currently, Pi Coin trades at $1.38, struggling to reclaim its lost ground. The $1.43 resistance level remains a significant hurdle, preventing any potential upward movement. Until PI breaks through this barrier, the risk of another downturn remains high.

At the same time, the $1.19 support level serves as a crucial safety net. If PI falls below this point, it could trigger a sharper decline. A breakdown at this level might push the price toward $0.76, worsening the losses. The next few days will be critical in determining whether Pi can stabilize or if further declines are inevitable.

Will Pi Network Recover? Here’s What Must Happen

Pi Network needs two major shifts to reverse its current trajectory. First, it requires an increase in buying pressure. More investors must enter the market to drive prices higher and reduce selling pressure. Without a surge in demand, the token will struggle to regain momentum.

Second, market sentiment must improve. Broader cryptocurrency trends significantly impact Pi Network’s price movements. If the crypto market sees renewed optimism, Pi Network could ride that momentum and recover lost value. However, the current environment remains uncertain, making a recovery less likely unless conditions change.

What Should Investors Do Now?

Traders should monitor the $1.19 support level closely. If the price falls below this mark, further declines may follow. Investors considering buying the dip should assess whether Pi Network has long-term growth potential. Right now, the indicators suggest caution rather than confidence.

Market watchers should also pay attention to the MACD and CMF indicators. If these signals shift toward a bullish outlook, the probability of a recovery increases. Until then, staying informed and watching price movements carefully will be essential.

Read Also: Pi Network to Unlock $188M in Tokens – Will the $1.92 Price Hold?

In conclusion, Pi Network faces a crucial moment in its journey. The 23% drop has raised concerns, and investors are questioning whether the token will recover. If Pi Network fails to hold $1.19, a deeper correction could occur. On the other hand, breaking above $1.43 would signal strength and open the door for a move toward $1.64.

The next few days will be critical. Will Pi Network find support and rebound, or will selling pressure continue? Investors must stay alert, as the market could shift quickly. Keep watching for key price movements and market trends to determine the next steps for this struggling token.