Dogecoin (DOGE) is surging after the U.S. Securities and Exchange Commission (SEC) accepted Grayscale’s DOGE exchange-traded fund (ETF) application. This marks a major milestone for institutional adoption, signaling potential mainstream recognition of the meme-based cryptocurrency. Though the acceptance does not guarantee approval, it reflects increasing regulatory openness toward crypto investment products. If approved, the ETF could boost DOGE’s liquidity and credibility, attracting new investors and fueling further price appreciation.

Dogecoin Price Analysis: Key Resistance Levels in Focus

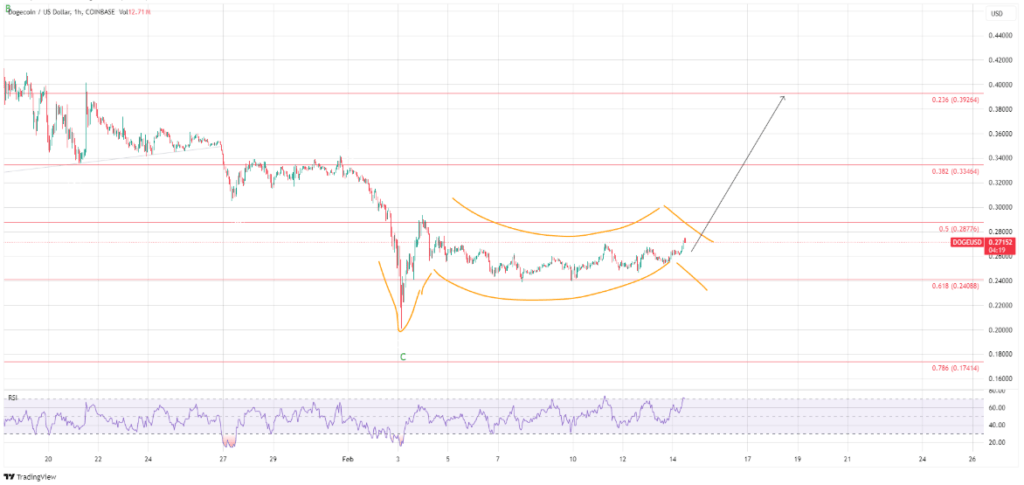

The recent price action shows DOGE rebounding strongly from a prolonged correction phase. After completing a five-wave impulsive structure, DOGE dipped into an ABC corrective wave, bottoming out near $0.20 at the 0.786 Fibonacci retracement level. This critical support zone triggered a recovery, propelling DOGE toward significant resistance levels. Currently, DOGE is trading near $0.27, testing the 0.5 Fibonacci retracement level at $0.287. Breaking this resistance could send DOGE toward $0.33 and possibly $0.39, aligning with the 0.382 and 0.236 Fibonacci retracement levels, respectively.

The Relative Strength Index (RSI) on the 4-hour chart indicates growing bullish momentum. The indicator shows a divergence, suggesting that buyers are gaining control. However, DOGE must hold above $0.24 to sustain this bullish structure. Failing to do so could lead to a retest of $0.17 before another upward attempt.

Dogecoin Forms Bullish Pattern: Can It Break $0.30?

On the 1-hour chart, DOGE is forming a classic cup and handle pattern, a well-known bullish reversal signal. The neckline of this formation sits around $0.30, coinciding with the 0.5 Fibonacci retracement level. A breakout above this zone could confirm a strong upward move toward $0.33 and eventually $0.39. If momentum strengthens, DOGE may even challenge previous highs, driven by increasing speculation and ETF-related enthusiasm.

While momentum indicators favor a bullish breakout, traders should watch for potential rejection at $0.287. A failure to hold above this level might lead to a pullback toward $0.24, where buyers could step in again. If the pattern plays out successfully, DOGE could enter a new bullish phase, targeting key resistance levels last seen in late 2024.

Market Outlook: Will DOGE Maintain Its Uptrend?

Traders remain optimistic as DOGE holds strong above crucial support levels. The SEC’s ETF review has injected fresh excitement into the market, but sustained gains require continued buying pressure. The broader crypto market sentiment also plays a significant role in DOGE’s trajectory. If Bitcoin and Ethereum maintain their bullish trends, DOGE could ride the wave and attract more investors.

A successful close above $0.287 could set the stage for a sustained rally toward $0.33 and $0.39. However, if sellers regain control, DOGE might experience a temporary pullback before its next move. Given the ongoing ETF developments and technical patterns, DOGE appears poised for further price appreciation in the coming weeks.

What This Means for Traders and Investors

Short-term traders should watch the $0.287 resistance closely. A breakout above this level may signal a strong buying opportunity. For long-term investors, the ETF approval process remains a crucial factor. If regulators greenlight the fund, DOGE could see heightened institutional demand, pushing its value even higher. While risks remain, the current market structure suggests that DOGE has room for further gains.

Read Also: Dogecoin Surges 4% After Elon Musk’s DOGE Website Launch—$0.5740 Price Target in Sight?

The SEC’s acceptance of Grayscale’s DOGE ETF application has reignited interest in Dogecoin. While final approval remains uncertain, the market has responded positively, pushing DOGE toward critical resistance levels. Breaking above $0.287 could open the door for a move to $0.33 and beyond. However, traders should remain cautious, as failure to hold above key support could lead to temporary pullbacks. As institutional interest grows, DOGE’s long-term prospects continue to strengthen. With momentum building, all eyes remain on whether DOGE can sustain this rally and establish new highs in 2025.