XRP’s price action has been anything but dull. After a shocking 35% drop in one day, it quickly rebounded. While some traders panicked, whales capitalized on the dip, accumulating millions of coins. This activity signals renewed confidence in XRP’s long-term potential.

Whales Are Buying Big – What’s Happening?

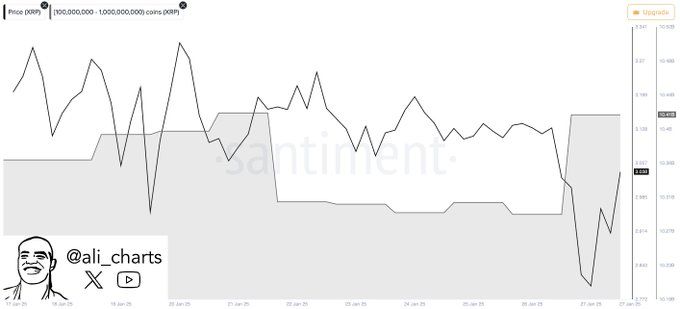

Crypto whales wasted no time during XRP’s sudden decline. They snapped up 520 million XRP almost immediately. Just days before, they had already purchased 120 million XRP after Ripple secured key regulatory approvals in New York and Texas. These consecutive purchases indicate that institutional players see massive upside potential.

When whales accumulate during downturns, it often signals an impending price surge. With XRP’s ecosystem growing rapidly, it’s clear why big investors remain bullish. The cryptocurrency continues to gain traction across institutional markets, adding to its credibility.

Institutional Adoption Fuels Momentum

Beyond whale activity, institutional interest in XRP is rising. Ripple’s latest market report highlights significant growth, reinforcing expectations for a major rally. Several developments are driving this momentum.

Read Also: XRP Surges with $11.2M Weekly Inflow – Can It Break $2.37 Resistance…

Firms such as WisdomTree, 21Shares, and Canary have filed for XRP-related Exchange Traded Products (ETPs) in the U.S. Ripple’s RLUSD stablecoin reached a $100 million market cap within a month, showcasing XRP’s increasing real-world adoption. Meanwhile, trading volume on XRPL’s decentralized exchange (DEX) surged to $1 billion in Q4 2024. These signs point to growing usage and trust in XRP’s ecosystem.

XRP’s 280% Rally – Can It Happen Again?

XRP demonstrated explosive growth in late 2024. Following President Trump’s election victory, crypto regulations became clearer, and investor confidence soared. In response, XRP skyrocketed 280% in just a few months. Trading volumes jumped from $500 million daily in November to $5 billion daily in December, reaching a peak of $25 billion in a single day.

Analysts believe another surge could be on the horizon. Historical patterns suggest that XRP may repeat this impressive rally. Given the recent accumulation and growing adoption, many expect a significant move soon.

Technical Indicators Signal a Breakout

Market analyst Egrag Crypto has identified a bullish setup for XRP. He notes that the cryptocurrency remains above the Bull Market Support Band (BMSB), a key indicator of an upcoming rally. In 2017, XRP gained 1,500% in just four weeks after touching this level. If history repeats itself, XRP could surpass $27 in the near future.

With strong fundamentals and favorable technical indicators, XRP is positioned for significant gains. Investors watching these signals may see substantial opportunities in the months ahead.

Where Is XRP Now & What Comes Next?

At the time of writing, XRP is trading at $2.40, reflecting a 1.1% increase in the past 24 hours. Despite short-term fluctuations, major investors continue accumulating. Institutional confidence remains high, and technical signals favor a breakout.

If momentum builds and whales continue their buying spree, XRP’s next big move could unfold soon. Traders should monitor price levels closely and prepare for potential volatility. The combination of strong fundamentals and historical price action suggests a promising future for XRP.

Final Thoughts – Is This the Right Time to Buy XRP?

XRP’s market position looks stronger than ever. Its rising adoption, whale accumulation, and favorable technical patterns create an exciting outlook. While no investment is risk-free, XRP’s recent activity suggests a powerful opportunity may be developing.

Read Also: Shiba Inu Drops 4.24% in a Week: Can SHIB Bounce Back?…

With XRP’s past performance and current market indicators aligning, a major rally could be imminent. Investors looking to enter should consider watching support levels and trend signals for the right entry points. The market remains dynamic, but the long-term potential appears bright.