Dogecoin’s recent surge saw a record-breaking 61 billion DOGE transacted in a single day, setting a new high in whale movements for the past year. This massive increase in large-scale transactions has raised concerns about potential behind-the-scenes activities. Whale transactions, usually involving large holders, suggest significant market involvement that may point to either redistribution or accumulation. Due to their transaction size, whales can heavily impact Dogecoin’s price, and their high activity levels often signal possible volatility ahead.

Intense Rally Fuels High Transaction Volume

Aligned with Dogecoin’s impressive rally, which has pushed its price to annual highs, on-chain data reveals continued high transaction volume, with over 60 billion DOGE moved in the past 24 hours alone. Analysis by IntoTheBlock indicates that 96.18% of Dogecoin addresses are currently “in the money,” meaning most holders are profiting at these price levels. This strong on-chain performance reflects a bullish market sentiment, suggesting potential for further price growth.

Rising Prices Attract Retail Investors

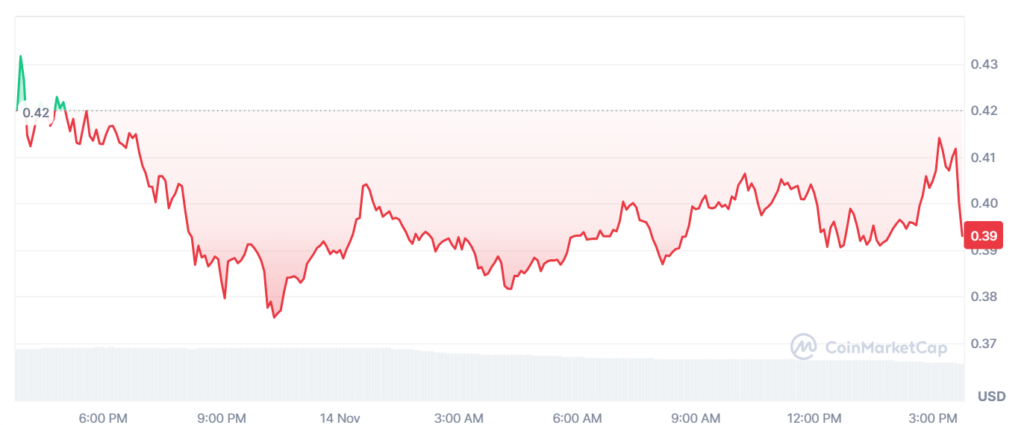

The recent price surge has rekindled interest among retail investors, drawn to Dogecoin’s recent upswing toward the $0.40 mark. As the rally continues, investors are focusing on the key resistance zone around $0.40 and the next target level of $0.50. Breaking these points could push DOGE even higher.

Source: CoinMarketCap

However, some analysts caution that increased whale activity could lead to a correction if large holders decide to cash out. This situation presents an uncertain outlook, where prices could either continue upward or experience a steep drop, depending on whether whales accumulate or sell.

Related article: Dogecoin on the Rise: Wallet Trends Signal a Market Shift

Investors are advised to watch for signals from whale activity, as extreme transactions could drive volatility. Whales often capitalize on peak activity by either driving up prices or triggering sell-offs. If whale transactions show more selling than accumulating, a correction could follow Dogecoin’s rapid ascent.

While Dogecoin’s recent performance reflects strong market optimism, the high whale activity indicates potential risks that investors should consider as they monitor the cryptocurrency’s next moves.